UNIFY Team Automates to Keep Up with Growth

How It All Started

With hundreds of branch and ATM locations nationwide, UNIFY Financial Credit Union (UNIFY) offers a wide selection of financial products and services to assist members in building and preserving wealth. The credit union was established in 1948 and is headquartered in California.

Following a successful company rebrand and several organizational changes, UNIFY sought to take its account reconciliation process to the next level through automation.

With the credit union growing larger each year, the accounting team needed a better way to track and prepare reconciliations.

For years, UNFIY’s manual processes contributed to:

- Decreased accountability

- Unreliable tracking in Excel checklists

- Cumbersome paper files and folders

- Time-consuming scanning procedures

- Challenging offline review process

- Unclear chain of command

- Over-burdened email inboxes

- Uncoordinated preparation and review process

“I can’t even imagine going back to doing manual reconciliations.”

– Tim H., Assistant Controller

Why ART?

After reviewing several competing software platforms, UNIFY chose SkyStem’s ART, as it met the team’s needs in terms of:

Key Features:

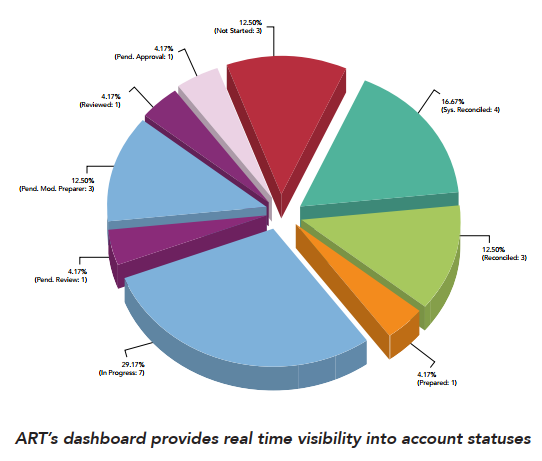

The robust performance of ART was a key differentiator when selecting to work with SkyStem. The E-Rec Binder feature allowed the team to truly own the process by downloading their work back to internal servers each month. Offering real-time updates on the status of accounts and exceptions, ART also allowed the UNIFY team to easily track progress and identify bottlenecks in the process.

Eliminating Paper:

ART’s cloud-based central repository enhanced control and accountability by eliminating cumbersome paper files, manual checklists, and outdated scanning protocols. By automating much of the manual, paper-based work, the UNIFY accounting team was able to focus on additional value-added activities within the department.

Flexibility:

UNIFY was especially pleased with the flexibility of ART, and the ability to provide restricted access to the company’s auditors. With a single click, auditors could see the completed work product for any account, thus meeting tight audit deadlines with ease. In addition, the ability to quickly implement and start using new modules on demand was a key determinant in the company’s selection process.

Cost:

SkyStem was able to meet UNIFY’s needs by keeping a conservative eye on its budget. ART is competitively priced and offers a thoughtfully curated set of features that best suit the credit union without extraneous and unnecessary functionality that added to the overall cost.

Implementation and Training

UNIFY’s dedicated site was implemented in 8 hours over three weeks’ time, and the software was soon live for the credit union’s first automated month-end close cycle.

With personalized training for both the system administrators and the team, the UNIFY accounting team was able to get up and running with minimal downtime and disruption to their schedule.

“Our implementation specialist at SkyStem was great. She gave excellent advice on best practices and walked us through the process step by step. Overall, it was a very straightforward process, and the feedback from the team was really positive.”

– Hugo S., VP Controller

“We implemented ART during a difficult rebrand, and the SkyStem team helped tremendously in changing domain names quickly. Without their help, the project would have been very challenging.”

– Tim H., Assistant Controller

The Results

- Since implementing ART, the UNIFY accounting team has achieved measurable results on many fronts. ART’s role in workflow management was especially noticeable during a recent audit when periods before and after ART’s implementation were chosen for inspection. The ability to provide auditors with relevant information on any account at the click of a button was paramount to adhering to the deadlines.

Customer Support

Ongoing customer support from knowledgeable SkyStem personnel and detailed user guides are available at no cost for all customers after implementation.

“Our team has truly grasped the system. Since we started using ART, I’ve hardly had to reject any reconciliations. ART makes it easy to log in and review recs from anywhere.”

– Tim H., Assistant Controller

Recommended Case Studies

Credit Union

Company Profile

Based in Madison and Milwaukee, with locations around Wisconsin, University of Wisconsin Credit Union (UWCU) has an asset size of over $5 billion, 300,000 members and is the 3rd largest credit union in Wisconsin.

- Customer Industry: Financial Services

- Asset Size: $5 billion

- Accounting Team Size: 13

Credit Union

Company Profile

KEMBA FCU was founded in 1933 as the credit union for the employees of the Kroger Company, and stands for Kroger Employee Mutual Benefits Association. Today KEMBA continues to serve Kroger associates, but also the employees of more than 175 additional area companies in Central Ohio.

- Ownership: Private

- Size: $1+ Billion in Assets

Credit Union

Company Profile

Founded in 1935 and headquartered in Jacksonville, Florida, 121 Financial Credit Union is one of the first credit unions in the United States. 121 FCU and has been Jacksonville’s hometown credit union for 85 years and counting. The credit union invests 100% of its capital back into the local community.

- Ownership: Private

- Size: Over $500 Million in Assets