Customer Service is ART’s Best Feature

How It All Started

Founded in 1935 and headquartered in Jacksonville, Florida, 121 Financial Credit Union (121 FCU) opened shortly after President Franklin D. Roosevelt signed the Federal Credit Union Act into law, making them one of the first credit unions in the United States. 121 FCU invests 100% of its capital back into the local community. The credit union is well known for working with various local small businesses helping them access Paycheck Protection Program funding during troubled times, resulting in thousands of local jobs being preserved.

121 Financial CU’s account reconciliation process was taxing and cumbersome for both the preparers and reviewers. Various Excel sheets were being used for tracking proposes and due to the manual nature of this activity, there was a great deal of uncertainty due to lack of real-time data. Reconciliations weren’t being done timely or correctly every time, and aged items that were discovered much later were later written off as temporary solutions.

121 FCU accounting team needed a more efficient process that would allow the team to be coordinated, standardized, and automated. The company evaluated several solutions and ended up selecting SkyStem. After 121 FCU prioritized their core needs – real-time status, tracking of aged open items, and task management – a product demo paired with top recommendations from other credit unions solidified 121 FCU’s controller, accounting manager, and CFO’s decision to select SkyStem’s month-end close and reconciliation automation solution, ART.

121 FCU immediately realized the enormous help that ART provided and how much it would eliminate the burden of the team’s current close process. ART would reduce the credit union’s dependency on Excel spreadsheets, organize deadlines and offer a way to manage closing procedures, which was very exciting for the whole team.

Why ART?

SkyStem’s ART solution met 121 FCU’s objectives in the following key areas:

Customer Support:

The accessibility of hands-on customer service experts was a vital factor for 121 FCU as that ensured the team’s objectives, vision, and needs were not lost. The ability to connect with a responsive customer support team has been a value-added element that has continued to serve the team throughout the implementation process and beyond.

Audit Trail:

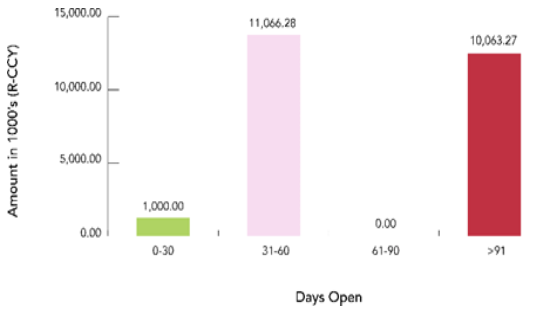

ART’s charts and dashboards provide various options for managing close and reconciliation status, accessing real-time updates, and improving communication across all accounts and team members. Centralizing all historical items, electronic sign-offs, and tracking has given the team confidence in the financials, significantly saving time during month-end close as well as during audits.

Task Management:

The flow and organization of the Task Master module alleviated a huge burden for the accounting team by proactively reminding task owners of incomplete or delinquent activities and providing accountability. This has kept the team on track to meet deadlines.

Time Saver:

ART allows electronic submission of reconciliations. This provides supervisors with full access to each reconciliation as soon as work is done. Email notifications and alerts let the team quickly identify and address time-sensitive issues. 121 FCU was able to start on reconciliations before closing the books and improving productivity.

Training & Customer Service

121 FCU focused on reconciliations when the team initially implemented ART. By the time the team adopted the Task Master module three months later, it was clear that they made the right decision by selecting ART. With a highly responsive and knowledgeable support staff, 121 FCU was able to fully adopt ART on its own timeline. Customer support was of the utmost importance for 121 FCU and the team considers it ART’s best feature. Comprised of subject matter experts with a deep understanding of the audit and month-end close process, SkyStem’s customer support team has been available to address all 121 FCU’s requests and questions quickly. The key to the successful implementation and adoption of any software or innovative process is to have support from the top down.

With a 97% award-winning customer satisfaction rating. 121 FCU received tailored customer service that fits its needs. In addition to having copious accessibility to all types of learning preferences like job aids, FAQs, and live- and web-based training, the team is even able to schedule one-on-one meetings to help each team member.

The Results

Since implementation, 121 FCU has achieved the following with the help of ART:

- Time savings due to increased efficiency

- Better ability to meet closing deadlines.

- Accurate reconciliations through multiple rounds of trial balance changes.

- Reliable and standardized reconciliation process.

- Increased transparency and accountability through the utilization of high-level dashboards and detailed executive reports.

- A shortened audit process.

- Timely email alerts for exceptions or impending delinquencies

- Real-time reconciliation and closing status updates

“The more we work in ART the more we like it. It gets better every time.”

Final Words from the Customer

For other organizations looking to implement ART, 121 Financial Credit Union’s Accounting Manager has the following advice:

“Customer service has never been an issue with SkyStem, tickets are resolved quickly and effectively. The ability to ask questions no matter how big or small and receive a timely resolution has far exceeded our expectations, and our standards were high, to begin with. We’re certain we wouldn’t have had this experience with another vendor.”

About SkyStem

Headquartered in the heart of New York City, SkyStem delivers a powerful month-end close solution for organizations seeking to streamline their financial processes. The company’s flagship solution, ART, is an enterprise technology that helps CFOs and Controllers shorten the month-end close and the time to issue financials by automating balance sheet reconciliations, managing month-end tasks, performing flux and variance analysis, and providing insightful reporting. The web-based solution streamlines and eliminates up to 90% of manual activities while strengthening internal controls and corporate governance.

Visit www.skystem.com to access more helpful materials.

Recommended Case Studies

Credit Union

Company Profile

Based in Madison and Milwaukee, with locations around Wisconsin, University of Wisconsin Credit Union (UWCU) has an asset size of over $5 billion, 300,000 members and is the 3rd largest credit union in Wisconsin.

- Customer Industry: Financial Services

- Asset Size: $5 billion

- Accounting Team Size: 13

Credit Union

Company Profile

KEMBA FCU was founded in 1933 as the credit union for the employees of the Kroger Company, and stands for Kroger Employee Mutual Benefits Association. Today KEMBA continues to serve Kroger associates, but also the employees of more than 175 additional area companies in Central Ohio.

- Ownership: Private

- Size: $1+ Billion in Assets

Credit Union

Company Profile

Publix Employees Federal Credit Union (PEFCU) was created in order to meet the financial needs of employees and associates of Publix Super Markets. Founded in 1957, PEFCU currently has over $1 billion in assets.

- Ownership: Private

- Size: $1+ Billion in Assets