Credit Union saves 30% of time with Automation Process

How It All Started

PEFCU’s account reconciliation process was increasingly burdensome and consistently exhausting in both time and resources. The accounting department was still very much driven by paper and manual work. After consistently missing key deadlines month to month, the PEFCU accounting team needed a standardized process, centralized system, and tracking capabilities, as their current process had proven to be inefficient. The biggest challenge for the accounting team was getting the most out of the time they had available to handle reconciliations as it was taking over two months to complete the entire reconciliation process.

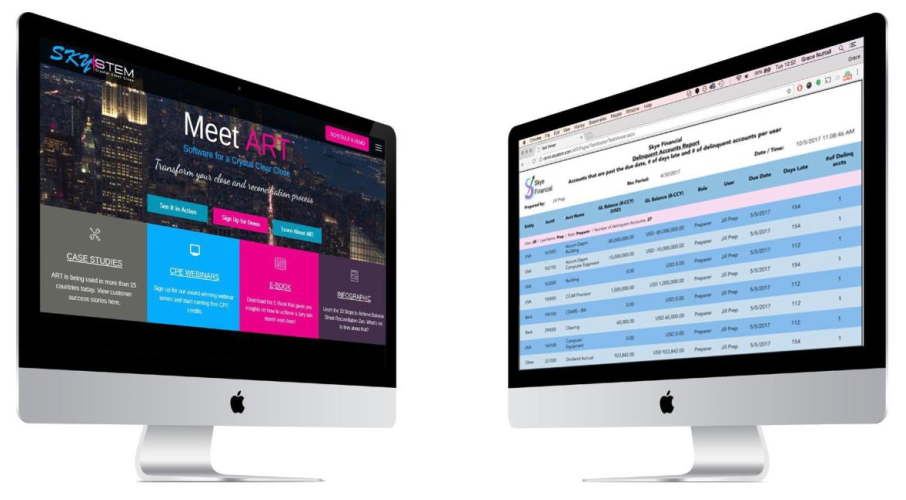

Despite the need for a better process, PEFCU wasn’t in the market to purchase a month–end close and reconciliation solution. However, after the controller was introduced to SkyStem at an industry event, a product demo of ART was presented to the accounting team soon thereafter. Immediately, PEFCU could see the benefits ART provided and realized how it would eliminate the pain points within their current close process. ART could lessen their dependence on Excel spreadsheets while offering an online approval process, organize deadlines and provide a way to manage closing procedures, which was very appealing to the entire team.

After evaluating SkyStem against BlackLine, PEFCU ultimately selected SkyStem’s month–end close and reconciliation automation solution –ART –based on the ease of the onboarding process, user-friendly interface, and the short implantation timeline.

Why ART?

SkyStem’s ART met the PEFCU team’s objectives in the following key areas:

Satisfactory Audits:

PEFCU was able to reduce the total time and effort needed to respond to auditor’s requests by allowing auditors access to ART. Audit trails and completion reports made it easy for auditors to review sign–off history and completion stats. With ART, the accounting team was able to cut down on the time needed to process reconciliations and meet the auditors’ completion timeline.

Key Features:

ART provided real–time updates on close and reconciliation status, instant visibility, and communication across all accounts. Email notifications and alerts allowed the team to quickly address concerns and identify time-sensitive activities.

Customer Support:

The availability of hands–on customer support was a critical factor for PEFCU. The accounting team understood that the quality of support received could mean the difference between a successful implementation and a failed project. Because of that, PEFCU was keen to partner with a vendor who valued a “high touch” approach to customer support.

Time Saver:

ART allows the accounting team to electronically submit prepared reconciliations for review, providing full access to the reviewer to see everything in one place and sign off electronically.

Training & Customer Service

Publix Employee FCU Training & Customer Service PEFCU’s accounting team put a high value on ease of use and customer service during the decision–making process when researching vendors. Thus, a highly responsive and knowledgeable support team was of the utmost importance. PEFCU’s implementation of ART was swift and painless. After a kickoff meeting with the SkyStem team, ART was set up in a matter of weeks and ready to go. Comprised of subject matter experts with deep knowledge of the audit and month–end close process, SkyStem’s customer support team has been available to address all of PEFCU’s questions and requests quickly.

With SkyStem’s award–winning 97% customer satisfaction rating, PEFCU’s accounting team typically received a resolution in a matter of hours. Along with personalized customer support, the availability of further training for both beginner and expert users is abundant, catering to all types of learning preferences: job aids, FAQs, and live– and web–based training.

The Results

Since implementation, ART has enabled PEFCU to achieve the following:

- Ease the sign-off process via electronic signoffs.

- Save the team 30% of the time on reconciliation reviews and status retrievals.

- Better satisfy internal and external auditors.

- Smooth adoption from implementation to go–live.

- Consistent reconciliation process.

- Met reconciliation deadlines consistently.

- Hands–on training and attentive customer support.

- Timely alerts of upcoming deadlines.

- Shorten the auditing process.

- Improve efficiency.

“Efficiency is standard, ART provides consistency across the board.”

Final Words from the Customer

For other organizations looking to implement ART, Publix Employee Federal Credit Union’s Controller has the following advice:

“SkyStem was very approachable throughout the whole process. The open implementation and timeline made the whole process easy. Their customer support is excellent, very prompt, and knowledgeable to help you every step of the way.”

About SkyStem

Headquartered in the heart of New York City, SkyStem delivers a powerful month-end close solution for organizations seeking to streamline their financial processes. The company’s flagship solution, ART, is an enterprise technology that helps CFOs and Controllers shorten the month-end close and the time to issue financials by automating balance sheet reconciliations, managing month-end tasks, performing flux and variance analysis, and providing insightful reporting. The web-based solution streamlines and eliminates up to 90% of manual activities while strengthening internal controls and corporate governance.

Visit www.skystem.com to access more helpful materials.

Recommended Case Studies

Credit Union

Company Profile

Based in Madison and Milwaukee, with locations around Wisconsin, University of Wisconsin Credit Union (UWCU) has an asset size of over $5 billion, 300,000 members and is the 3rd largest credit union in Wisconsin.

- Customer Industry: Financial Services

- Asset Size: $5 billion

- Accounting Team Size: 13

Credit Union

Company Profile

KEMBA FCU was founded in 1933 as the credit union for the employees of the Kroger Company, and stands for Kroger Employee Mutual Benefits Association. Today KEMBA continues to serve Kroger associates, but also the employees of more than 175 additional area companies in Central Ohio.

- Ownership: Private

- Size: $1+ Billion in Assets

Credit Union

Company Profile

Founded in 1935 and headquartered in Jacksonville, Florida, 121 Financial Credit Union is one of the first credit unions in the United States. 121 FCU and has been Jacksonville’s hometown credit union for 85 years and counting. The credit union invests 100% of its capital back into the local community.

- Ownership: Private

- Size: Over $500 Million in Assets