Stock Yards Uses ART To Automate Month-End Reconciliation Process

How it All Started

Stock Yards Bank & Trust (NASDAQ: SYBT) was founded in 1904. It has evolved from a small bank serving the Louisville livestock industry to a nationally recognized bank with assets totaling $2.4 billion. It has offices in the Louisville, Indianapolis, and Cincinnati market service areas.

Stock Yards Bank & Trust (NASDAQ: SYBT) was founded in 1904. It has evolved from a small bank serving the Louisville livestock industry to a nationally recognized bank with assets totaling $2.4 billion. It has offices in the Louisville, Indianapolis, and Cincinnati market service areas.

The Bank had grown organically and completed a small acquisition in 2013. As it increased in size and operational complexity, the Accounting Team found itself spending more and more time in the weeds of things when it came to reconciling balance sheet accounts each month – making sure reconciliations were signed off, tracking down supporting documentation and sign-offs, searching for invoices – with less and less time for tackling other important processes and strategic initiatives.

The Corporate Controller decided to search for tools that could help streamline the reconciliation process, as it was a critical but increasingly burdensome activity.

Two solutions were evaluated – SkyStem’s ART and Trintech’s Cadency.

Why ART?

The management team ultimately selected ART because it has the right combination of:

Powerful Features:

Which eliminates much of the administrative work with no extra bells and whistles that they didn’t need (and didn’t want to pay for).

Intuitive Design:

Which makes it easy to learn.

System Reconciliation Capabilities:

That monitor account balances and substantially reduce the number of accounts that require reconciliation.

Internal Controls and Compliance:

Via an audit trail, version control, and a real-time tracking system. Many of the Bank’s manual controls regarding the reconciliation process would be converted into automated controls.

Transparency and Accountability:

Through high-level dashboards and detailed reports for executives.

Speedy and Non-Disruptive Implementation:

As setting up ART does not require full-time resources or outside consultants and can be done in a matter of weeks.

”The implementation was flawless. Our trainer was able to share leading practices and show users how specific accounts should be reconciled in ART; something we were not always doing correctly in Excel. In fact, within the first two weeks of implementing ART, we discovered errors in two of our accounts and were able to immediately correct them.”

– C. Price, Accounting Manager

Implementation And Training

After being vetted by the Internal Audit team and the IT team, ART was implemented over the course of a few weeks.

All users were trained directly by SkyStem personnel, who are knowledgeable about the close and financial reporting process.

With a tracking system in place, details were no longer misplaced or forgotten. The Bank went from no system to a risk-lowering, totally

a transparent system with built-in accountability.

Results

Activities Made Possible Through ART

- Users reconcile to the latest GL balance

- Electronic sign-off on each reconciliation

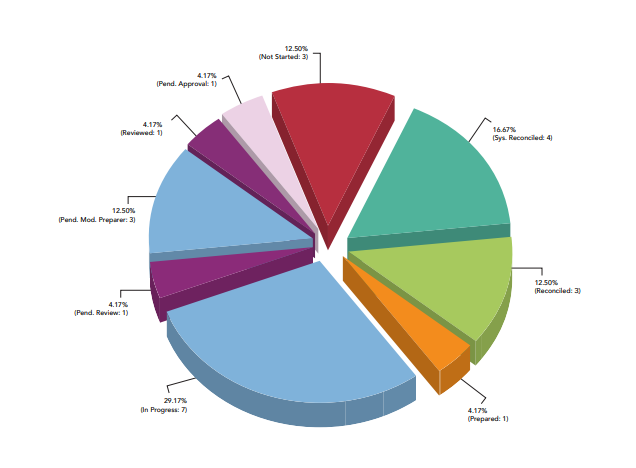

- Real-time status reporting

- Consistent enforcement of supporting documentation requirements

- Instant access to reconciliations and document attachments

- Review notes tracked electronically

- Faster, more efficient review process

- Automatic deadline email alerts

Process Time Savings Gained Using ART

30% to 35% of balance sheet reconciliations were system reconciled. In addition, a large number of other time-consuming activities were also eliminated:

- Creating cover/lead sheets for each account

- Updating reconciliation matrix each month

- Providing completion and sign-off status

- Printing reconciliations and other docs

- Preparing reconciliation binders

Customer Support

SkyStem’s customer support was – and still is – always available. There were no tickets to log, and no email forms to complete. Users who needed help could just pick up the phone or send a quick email, and the turnaround time for a live response was fast. It’s pretty nice to see a software vendor that is so focused on customer service.

They even created a review-note report for me so that I could use it to see what the notes were for the prior period. SkyStem is very responsive.

The SkyStem customer support team is comprised of former accountants with auditing experience. Their product expertise, coupled with industry knowledge, puts them in a position to quickly address our questions and any underlying process issues.

A Word From SkyStem

Software alone can’t make your problems go away, and Stock Yards understood this.

The CFO, Controller, and Accounting Manager all saw the value ART could bring to the Accounting Department and worked hard to ensure total adoption and optimization.

Not everyone in the department welcomed ART at first. Some wanted to keep doing things the way they had always done; going from very little visibility into the reconciliation process to 100% transparency can be scary.

However, the leadership team saw the resistance to change and positioned themselves for success by:

- Consistently communicating ART adoption expectations to the team, with zero tolerance for doing things the “old way.”

- Enforcing implementation deadlines.

- Providing information and feedback to the SkyStem team on a timely basis.

- Making users available for training, and encouraging them to ask customer support questions.

- Using ART’s review and monitoring functions to provide review notes to users.

- Continually exploring and optimizing ART features to achieve the best configuration.

Recommended Case Studies

Banking

Company profile

Operating over 50 locations across Maine, New Hampshire and Vermont, Bar Harbor Bank & Trust is headquartered in Bar Harbor, Maine. As a leading Northern New England community bank, Bar Harbor Bank & Trust offers a full range of personal and business banking services, as well as wealth management services through its subsidiary Bar Harbor Wealth Management.

- Asset size: $4 Billion

- Ownership: Public

Banking

Company Profile

Community National Bank has been serving Vermont communities for over 165 years organized in 1851 as the Peoples Bank, and nationally chartered in 1865 as the National Bank of Derby Line. It is a billion-dollar bank in northeastern Vermont, serving 7 counties, with 12 retail offices in Orleans, Essex, Caledonia, Washington, Franklin, and Lamoille counties.

- Asset Size: ~$1 Billion

- Ownership: Public

Banking

Company Profile

FirstBank Southwest was chartered as the First National Bank of Ochiltree in 1907. FirstBank Southwest has nine banking center locations in Amarillo, Booker, Hereford, Pampa, and Perryton, Texas, and has expanded to the DFW Metroplex, Austin, and San Antonio metro markets with Loan and Deposit Production Offices.

- Size: $1.6 Billion in Assets

- Ownership: Private