Growing Accounting Department Successfully Scales With ART

How It All Started

Based in Secaucus, New Jersey, Rose Brand is the largest provider of stage curtains, theatrical fabrics, production supplies, hardware and digital printing in North America. For over 100 years, they have supported the live entertainment industry in achieving quality production visuals.

Their accounting team began with only two people and used an outsourced accounting firm for financial reporting and miscellaneous tasks. Balance sheet reconciliations, calendars and the close checklist were all housed in Excel, contributing to a lack of standardization.

“It was kind of all over the place. People save things in different places, and you couldn’t always find the backup you needed when you needed it,” remembers Kaysha Menge, Director of Accounting at Rose Brand.

From community theater productions to Radio City Music Hall, Rose Brand continued their growth by expanding to new regional markets. Over the past decade, this included two acquisitions and several expansions of their facilities, sometimes doubling in size.

While scaling their accounting department, it became clear Rose Brand needed to take action to improve their month-end close process. As employee headcount shot up, Rose Brand decided to bring their financials in-house, amplifying the workload with the added challenge of consolidating month-end activities.

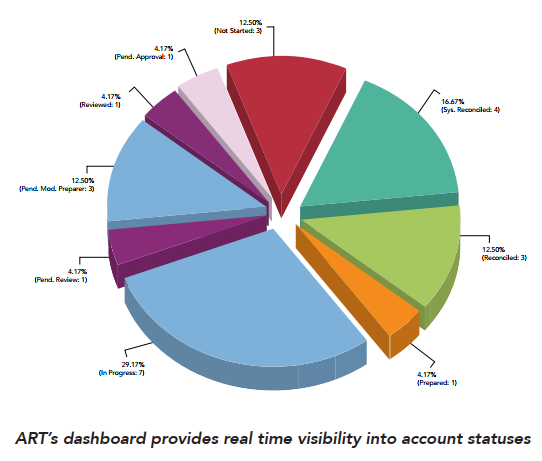

In 2017, Rose Brand’s CFO chose ART by SkyStem as their month-end close solution for the clear visualization of the dashboard and the ability to implement streamlined workflows.

Why ART?

SkyStem’s ART met Rose Brand’s key objectives in the following areas:

Task Tracker:

Previously managed in Excel, the month-end checklist traded hands frequently. As Rose Brand transitioned month-end work from outsourced to in-house, duties could be unclear, and a lack of a consistent workflow meant there was no “right way” to repeat the process month after month. The Task Tracker provided clear division of work along with visibility to management about the status of each item.

Better Reporting:

As a private company, Rose Brand is not restricted to a hard deadline for their month-end close. Despite this, the accounting team aimed to establish a consistent and high quality close schedule, in which ART has been an essential tool.

Central Repository:

Without a designated place to keep files, confusion on where to find information or notes caused delays. ART provided a home for all reconciliations and supporting documentation with the ability to painlessly pull anything needed for auditors as a neat PDF.

Fast Implementation:

A quick setup didn’t throw the department off track, and the team was swiftly able to adopt the technology with helpful guides and personalized customer service.

Improved Workflow:

Automating not only the reconciliations, but the workflow itself has allowed increased accountability and transparency into month-end activities. Scheduling is no longer manual.

The Results

- Since adopting ART, Rose Brand has been able to close faster and with more confidence. Keeping all necessary information in a central repository has allowed quicker, easier access to files. The accounting team can now get auditors same day requests on standardized forms.

- The most measurable benefit has been the streamlined workflows and task management enabled through ART’s Task Tracker. Instructions, templates, due dates and email alerts ensure the team stays on top of everything on the month-end checklist.

- As Rose Brand continues to grow, ART gives the accounting department the ability to seamlessly incorporate new staff into the month-end close to continually meet and exceed business goals.

“You guys have all the tools available to us. I also feel your customer support is excellent. I always get a quick response and everyone’s very helpful.”

– Director of Accounting, Rose Brand

Final Words from the Customer

For other organizations looking to implement ART, Rose Brand’s Director of Accounting has the following advice:

“As a management tool, one of the biggest benefits has been being able to see where my team is at and what they’re doing. If someone is struggling with the workflow process this is really something that can help.”

About SkyStem

Headquartered in the heart of New York City, SkyStem delivers a powerful month-end close solution for organizations seeking to streamline their financial processes. The company’s flagship solution, ART, is an enterprise technology that helps CFOs and Controllers shorten the month-end close and the time to issue financials by automating balance sheet reconciliations, managing month-end tasks, performing flux and variance analysis, and providing insightful reporting. The web-based solution streamlines and eliminates up to 90% of manual activities while strengthening internal controls and corporate governance. Visit www.skystem.com to access more helpful materials.

Recommended Case Studies

Credit Union

Company Profile

Based in Madison and Milwaukee, with locations around Wisconsin, University of Wisconsin Credit Union (UWCU) has an asset size of over $5 billion, 300,000 members and is the 3rd largest credit union in Wisconsin.

- Customer Industry: Financial Services

- Asset Size: $5 billion

- Accounting Team Size: 13

Banking

Company profile

Operating over 50 locations across Maine, New Hampshire and Vermont, Bar Harbor Bank & Trust is headquartered in Bar Harbor, Maine. As a leading Northern New England community bank, Bar Harbor Bank & Trust offers a full range of personal and business banking services, as well as wealth management services through its subsidiary Bar Harbor Wealth Management.

- Asset size: $4 Billion

- Ownership: Public

Banking

Company Profile

Community National Bank has been serving Vermont communities for over 165 years organized in 1851 as the Peoples Bank, and nationally chartered in 1865 as the National Bank of Derby Line. It is a billion-dollar bank in northeastern Vermont, serving 7 counties, with 12 retail offices in Orleans, Essex, Caledonia, Washington, Franklin, and Lamoille counties.

- Asset Size: ~$1 Billion

- Ownership: Public