Rhino Resource Partners Achieves Reconciliation Automation in 11 Days

How it All Started

Rhino Resource Partners LP is a master limited partnership that is focused on coal and energy-related assets and activities, including energy infrastructure investments. Founded in 2003, they are a diversified energy partnership that produces coal in multiple basins in the United States and manufactures key ingredients used by steel producers worldwide.

Rhino’s account reconciliation process was becoming increasingly unwieldy. Acquisition activities, coupled with multiple locations resulted in inconsistent processes and disparate locations for storing documents related to the close. Over time, audit requirements became difficult to meet, as every balance sheet account had to be reconciled and all supporting documents had to be attached.

The VP and Controller decided it was time to revitalize the company’s reconciliation process with automated reconciliation software. Two solutions were evaluated – SkyStem’s ART and BlackLine.

“I started out just wanting someplace I could store and review things. My list of must-haves grew when I saw everything ART could do.”

– Liz B., VP, and Controller

Why ART?

The management team ultimately selected ART because it enabled them to:

Reconcile More Accounts:

With ART systematically reconciling up to 35% of the account population, all accounts are now properly reconciled without increasing the workload.

Shorten the Reconciliation Timeframe:

In order to meet the auditor’s 5-day completion requirement, Rhino continues to utilize ART’s standardized coversheets and approval workflow to dramatically shorten the review time.

Eliminate Binders:

The audit team required supporting documentation for each account reconciliation. ART’s central repository eliminates the process of retrieving documents from multiple shared drives and printing them for 3-ring binders.

Minimize Work During the Audit:

Rhino was able to reduce the total effort required in responding to auditor requests by allowing auditors restricted access to ART.

The Results

Reconciliation Goals Met With ART

- Approximately 35% of balance sheet reconciliations are system reconciled

- Cover/lead sheets are generated automatically each month

- All balance sheet accounts are now reconciled in less time

- Electronic sign-offs are easy to see

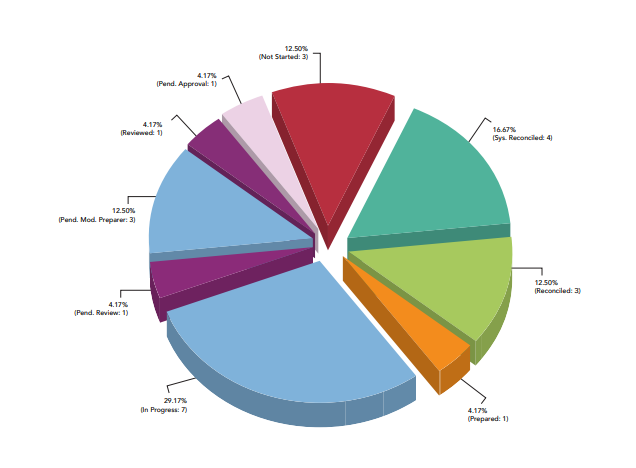

- Real-time reconciliation statuses are visible

- Printing and manual archiving are avoided

- Reconciliation process is standardized for all companies with ART’s standard forms

Implementation

SkyStem and Rhino’s accounting team kicked off the implementation project mid-month and were ready for their first automated month-end close and reconciliation cycle in less than 2 weeks.

All users were trained directly by SkyStem personnel, who were knowledgeable about the close and financial reporting process.

Our training period was short. The trainer knew all about the reconciliation and auditing process and left us with detailed instructions. Many of us never needed to call customer support. We had the necessary documentation and were off and running. A lot can be done faster. The email warnings for preparers and reviewers have been really helpful to get us going.

Implementation-rhino

I don’t know if you can get better customer service. I’ve logged tickets at all different hours and have gotten responses.

From my questions during the sales process to my questions during implementation, I always received a timely response from SkyStem. I’ve never been left hanging.

Customer Support

Already enduring the challenge of a new ERP system, the Rhino finance team put a high value on customer service and ease of use when seeking an account reconciliation automation vendor. Thus, a highly responsive and knowledgeable support team was of the utmost importance.

A Word From SkyStem

The accounting team at Rhino Resource Partners understood that the key to a successful implementation and adoption of any software or new process was to have support from the top down. From the beginning, the Corporate Controller encouraged the team to embrace the new process, in order to reap the benefits of internal controls and process automation as quickly as possible.

They completed implementation in 11 days. The key to Rhino’s success consisted of:

- Following implementation steps and sharing requested data prior to the project’s launch

- Identifying potential issues when and working through them with the implementation team

- Keeping SkyStem aware of updates and questions during the implementation period

- Making users available for training, encouraging them to ask customer support questions

- Ensuring the team had access to all instructions

- Committing to optimizing ART

Recommended Case Studies

Credit Union

Company Profile

Based in Madison and Milwaukee, with locations around Wisconsin, University of Wisconsin Credit Union (UWCU) has an asset size of over $5 billion, 300,000 members and is the 3rd largest credit union in Wisconsin.

- Customer Industry: Financial Services

- Asset Size: $5 billion

- Accounting Team Size: 13

Banking

Company profile

Operating over 50 locations across Maine, New Hampshire and Vermont, Bar Harbor Bank & Trust is headquartered in Bar Harbor, Maine. As a leading Northern New England community bank, Bar Harbor Bank & Trust offers a full range of personal and business banking services, as well as wealth management services through its subsidiary Bar Harbor Wealth Management.

- Asset size: $4 Billion

- Ownership: Public

Banking

Company Profile

Community National Bank has been serving Vermont communities for over 165 years organized in 1851 as the Peoples Bank, and nationally chartered in 1865 as the National Bank of Derby Line. It is a billion-dollar bank in northeastern Vermont, serving 7 counties, with 12 retail offices in Orleans, Essex, Caledonia, Washington, Franklin, and Lamoille counties.

- Asset Size: ~$1 Billion

- Ownership: Public