Bank Reduces 25% of Reconciliation Volume Through ART

How It All Started

With nearly $2.2 billion in assets, over 300 employees, and 15 locations stretching across Maine, the team at Machias Savings Bank believes that with every relationship there is a way to keep customers moving forward, now and in the future. Founded in 1869, and a leader in customer experience and community, Machias makes an impact beyond products and services by donating nearly $1 million to Maine’s non-profits. Machias Savings Bank was named the #1 Best Small Bank in Maine in 2020 by Newsweek. In 2021, it ranked #2 in the Best Places to Work For and was ranked #8 in the Best Bank to Work Within the Nation by American Banker Magazine.

Historically, much like other community banks, Machias relied heavily on spreadsheets to manage month-end work. To track monthly reconciliations, the accounting team used a central spreadsheet that was managed throughout the close. In 2013, the bank crossed $1 billion in assets, which was when it became subject to more rigorous regulatory requirements. The accounting team knew it needed a stronger internal controls program.

The central spreadsheet was enhanced to become more complex, which also made it more cumbersome. It was effective, but extremely manual and needed constant attention. The responsibility of tracking and managing the central reconciliation spreadsheet was placed under the responsibility of one person, who spent a lot of time carefully double and triple checking during the close.

This prompted management to recognize a need to put a system in place to relieve leadership of such manual and administrative tasks.

Why ART?

In 2018, the team at Machias Savings Bank scheduled introductory conversations with four different vendors to evaluate month-end close automation. From those, the team held product demos with three of the vendors.

They evaluated systems that offered everything from artificial intelligence and auto-matching activities to reporting systems that can pull data to build executive reports. While those technologies were interesting, the accounting team had a much more targeted focus on month-end needs.

The team was looking for a platform that could:

- Assist with reconciliations at month-end.

- Act as a central repository for documents.

- Replace the existing tracking spreadsheet.

- Provide a more robust closing checklist.

In addition, the team was also looking to partner with a company that could provide personalized customer service during the change process.

The Results

The Bank has a handful of accountants in the department that participate in month-end close and a three-day close schedule.

ART was implemented over the course of one month and all users were trained by a licensed CPA prior to going live on the first cycle. Within the first few cycles, the team started to enjoy the benefits of automation, including:

- Up to 25% reduction of reconciliation volume each month due to ART systematically completing those reconciliations due to preset algorithm.

- No more need to constantly update the central tracker to mark off reconciliation completion.

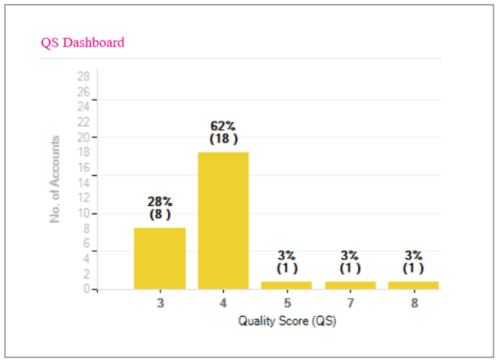

- Accessing real-time dashboards on close and reconciliation status completion throughout the month.

- A central location in which important documents can be stored alongside closing tasks and reconciliations and reducing the need to manage share drive folders and/or individual desktop folders.

- Having an organized method of presenting information for the auditor.

“At first, we were hesitant. Then the more we learned about [ART], the more comfortable we felt. Now we love it.”

– VP Accounting, Machias Savings Bank

Final Words from the Customer

For other organizations looking to implement ART, Machias Savings Bank has the following advice:

“[ART] helped us get to a place where we could be confident in our month-end close process while spending less time managing that process. As a result, we freed up valuable resources in our department, especially with our accounting manager who was relieved of the arduous task of manual tracking and was able to redirect her time to bigger and better things.”

– SVP Accounting and Finance, Machias Savings Bank

About SkyStem

Headquartered in the heart of New York City, SkyStem delivers a powerful month-end close solution for organizations seeking to streamline their financial processes. The company’s flagship solution, ART, is an enterprise technology that helps CFOs and Controllers shorten the month-end close and the time to issue financials by automating balance sheet reconciliations, managing month-end tasks, performing flux and variance analysis, and providing insightful reporting. The web-based solution streamlines and eliminates up to 90% of manual activities while strengthening internal controls and corporate governance.

Visit www.skystem.com to access more helpful materials.

Recommended Case Studies

Banking

Company profile

Operating over 50 locations across Maine, New Hampshire and Vermont, Bar Harbor Bank & Trust is headquartered in Bar Harbor, Maine. As a leading Northern New England community bank, Bar Harbor Bank & Trust offers a full range of personal and business banking services, as well as wealth management services through its subsidiary Bar Harbor Wealth Management.

- Asset size: $4 Billion

- Ownership: Public

Banking

Company Profile

Community National Bank has been serving Vermont communities for over 165 years organized in 1851 as the Peoples Bank, and nationally chartered in 1865 as the National Bank of Derby Line. It is a billion-dollar bank in northeastern Vermont, serving 7 counties, with 12 retail offices in Orleans, Essex, Caledonia, Washington, Franklin, and Lamoille counties.

- Asset Size: ~$1 Billion

- Ownership: Public

Banking

Company Profile

FirstBank Southwest was chartered as the First National Bank of Ochiltree in 1907. FirstBank Southwest has nine banking center locations in Amarillo, Booker, Hereford, Pampa, and Perryton, Texas, and has expanded to the DFW Metroplex, Austin, and San Antonio metro markets with Loan and Deposit Production Offices.

- Size: $1.6 Billion in Assets

- Ownership: Private