Increasing Reconciliation Quality and Preventing Risk with Automation

How It All Started

Since 1902, Lake Health has provided a community health system for patient and family-centered care in Northeast Ohio. As a private, not-for-profit leader in community health care, Lake Health provides its services with the help of 600 physicians, 2,900 healthcare professionals, and almost 1,000 volunteers at multiple facilities. The not-for-profit is the largest private employer in Lake County, providing comprehensive healthcare services to residents and neighboring communities with hospitals and healthcare facilities.

Lake Health’s accounting team was struggling with timeliness and lack of consistent quality during the reconciliation review process each month. The concern with lack of accuracy increased when the team experienced difficulties in implementing a companywide standard reconciliation template. Occasionally, the accounting team was also catching accounts that were not being reconciled.

Before implementing ART, Lake Health was managing reconciliations of high-risk accounts with a spreadsheet checklist. High-risk accounts required reconciliation preparation and review to occur within a certain timeframe before the next period. Medium and low-risk accounts were either reconciled on an ad hoc basis, or through semi-annual balance sheet reviews. Ownership was sometimes designated to groups, and not clearly assigned to individuals, which was not ideal.

A staff accountant took the initiative to search for an automated solution. Specifically, the team was in need of a tool that provided visibility, transparency, efficiency, and automated tracking of reconciliation status each month. The team also desired a solution that could highlight, identify and aid in timely error resolution.

Lake Health evaluated several automated close and reconciliation products, including Fiserv Frontier, Oracle, and SkyStem’s ART, ultimately selecting ART.

Why ART?

SkyStem’s ART met the accounting team’s objectives in the following key areas:

System Functionality:

One of Lake Health’s requirements for a reconciliation tool was that it be web-based and allow the team visibility into the status of each account. With ART, reconciliation reviewers are able to track progress and electronically sign off on the team’s work, providing efficiency and transparency to the reconciliation workflow.

User-Defined Capabilities:

When evaluating other vendors, Lake Health found that ART had more user-defined capabilities that would suit the accounting team’s needs.

Cost Control:

ART was the most affordably priced solution among the three systems evaluated, as ART incorporated a robust set of features that were all included without additional fees.

Task Module:

ART was the only system that had a task management module included, which allowed Lake Health to manage activities such as the month-end close checklist.

“ART’s visibility has helped us find reserves that our team didn’t know we had before because we were overlooking details within a larger bucket of accounts.”

Implementation & Training

Lake Health implemented ART within one month which meant minimal disruption to the team’s schedule. The accounting team received personalized training from SkyStem Personnel, who were knowledgeable about Lake Health’s process, goals, and objectives.

SkyStem’s fast implementation process, combined with strong leadership and full participation from the Lake Health team, put Lake Health ahead of the team’s internal project schedule, allotting time for the team to focus on other deadlines.

After ART’s adoption, Lake Health’s accounting team utilized SkyStem’s Genius Academy (weekly training courses) and one-on-one private coaching. The team also appreciated the System Administrator Guide and User Guide, and have recommended both to new users. Today, the team encourages new users to take advantage of these complimentary self-help tools.

As a result, Lake Health’s accounting team was able to further increase visibility, improve quality, and prevent risk in the reconciliation process, as well as automate the management of month-end closing tasks to ensure a clean and clear month-end close.

“Initially, when we first implemented ART, we were overwhelmed. SkyStem’s help desk tools and live customer support provided the information we needed to not only shorten adoption time but also increase the quality of the work to prevent risks.”

The Results

Lake Health chose ART to establish an accurate and structured close and reconciliation process, along with a centralized repository.

Since implementation, ART has enabled Lake Health to:

- Lower risk with high-quality reconciliations

- Save time using net accounts

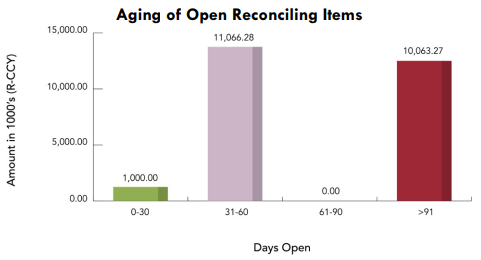

- Clear outstanding items on a timely basis

- Achieve accessibility for auditors

- Increase visibility within the entire process

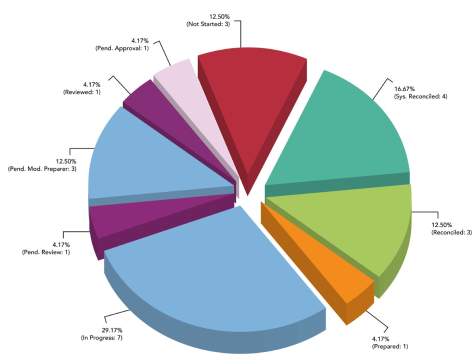

- Report status in real-time

- Attach support to reconciliations electronically

- Instantly access reconciliations and documents

- Communicate responsibilities clearly

- Enforce standardization

- Review faster and more efficiently

- Alert users of upcoming deadlines via emails

Auditor Satisfaction

Since implementing ART, Lake Health’s auditors have expressed satisfaction with the improvement of internal controls over financial reporting. The accounting team has been able to retrieve documents faster than before for audits and provide accurate data in real-time to auditors with ART’s system reports.

The auditors were satisfied with the efficiency of data collection and its quality in comparison to past audits. They also appreciated the ability to simply export the entire period’s reconciliation work if they chose to review certain accounts.

“Thanks to ART we now have the correct data for review, which has created clear communication of responsibilities and expectations.”

Customer Support

Lake Health’s accounting team was extremely pleased with the customer support they received.

SkyStem’s customer support team provided Lake Health’s accounting staff with the appropriate material and resources for their specific needs. With the proper support, the accounting team was able to significantly improve the quality of data and visibility of the process to complete the close in a timely manner.

“SkyStem’s customer support team members have been very helpful given their former accounting and auditing experience. They have been very prompt at responding and are always able to send the appropriate resources.”

Final Words from the Customer

For other organizations looking to implement ART, Lake Health’s Director of Accounting has the following advice:

“ART should really be considered for companies that are looking for continuous operational improvement. ART can eliminate a lot of the manual spreadsheets, which will allow more visibility. It allows accounting teams to focus more on qualitative work rather than the administrative tasks.”

About SkyStem

SkyStem is based in New York and makes software called ART, a month-end close and balance sheet reconciliation solution that is easy to use and fast to implement. We are proud to offer one of the most affordable and effective solutions of its kind in the market today

Visit www.skystem.com to access more helpful materials.

Recommended Case Studies

Credit Union

Company Profile

Based in Madison and Milwaukee, with locations around Wisconsin, University of Wisconsin Credit Union (UWCU) has an asset size of over $5 billion, 300,000 members and is the 3rd largest credit union in Wisconsin.

- Customer Industry: Financial Services

- Asset Size: $5 billion

- Accounting Team Size: 13

Banking

Company profile

Operating over 50 locations across Maine, New Hampshire and Vermont, Bar Harbor Bank & Trust is headquartered in Bar Harbor, Maine. As a leading Northern New England community bank, Bar Harbor Bank & Trust offers a full range of personal and business banking services, as well as wealth management services through its subsidiary Bar Harbor Wealth Management.

- Asset size: $4 Billion

- Ownership: Public

Banking

Company Profile

Community National Bank has been serving Vermont communities for over 165 years organized in 1851 as the Peoples Bank, and nationally chartered in 1865 as the National Bank of Derby Line. It is a billion-dollar bank in northeastern Vermont, serving 7 counties, with 12 retail offices in Orleans, Essex, Caledonia, Washington, Franklin, and Lamoille counties.

- Asset Size: ~$1 Billion

- Ownership: Public