AT A GLANCE

The Problem

After 5 FDIC mergers from 2010-2012, Heartland Bank found themselves struggling with the inefficiencies of manual reconciliations. Their accounting department faced higher balances and more accounts with no standardized process. “It was all over the board,” Controller Jim Lyons remembers, “There really wasn’t one consistent method and we hadn’t developed a methodology for all reconcilements to follow.”

Pressure mounted from internal auditors for better documentation on a more regular basis, leading Heartland to pursue automation as a solution.

The Solution

In 2013 Heartland Bank adopted SkyStem’s ART, a month-end close automation and workflow tool that eliminates up to 90% of manual close activities. Since then they’ve enjoyed a greater peace of mind in the department while having a streamlined process with accounts now reconciled more regularly. “Overall, it’s been a very favorable experience with customer service. The response is always very prompt and the solution really quick and easy to implement,” reflects Mr. Lyons.

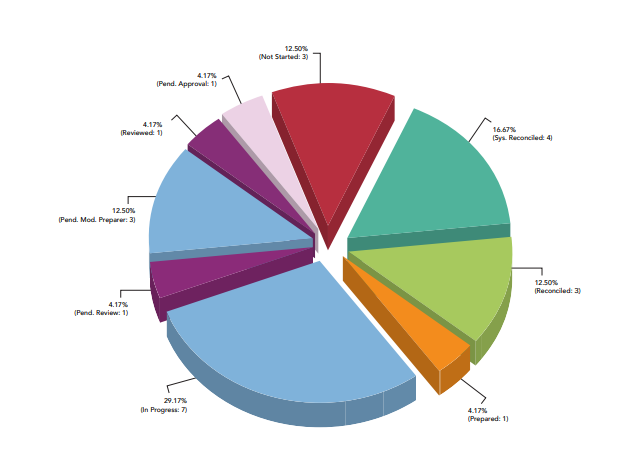

The Results

Improved Internal Controls:

Improved Internal Controls:

With features like risk rating, electronic sign-offs, and review status, reconciliations stopped slipping through the cracks.

Time Saved:

since implementing ART, Heartland Bank has cut down on elapsed time, making space for more high-value work.

Happier Auditors:

Internal access, clearer documentation, no more tracking down reconciliations-what’s not to love? When the auditors are happy, your team is happy.

“It’s much easier to find reconcilements through SkyStem because everything is based on the GL account number. Having a tool like that is worth the price.”

– Jim Lyons Controller, Heartland Bank

Ready to write your own success story? Schedule a demo of ART today! info@skystem.com (644) 833-3177

Recommended Case Studies

Banking

Company profile

Operating over 50 locations across Maine, New Hampshire and Vermont, Bar Harbor Bank & Trust is headquartered in Bar Harbor, Maine. As a leading Northern New England community bank, Bar Harbor Bank & Trust offers a full range of personal and business banking services, as well as wealth management services through its subsidiary Bar Harbor Wealth Management.

- Asset size: $4 Billion

- Ownership: Public

Banking

Company Profile

Community National Bank has been serving Vermont communities for over 165 years organized in 1851 as the Peoples Bank, and nationally chartered in 1865 as the National Bank of Derby Line. It is a billion-dollar bank in northeastern Vermont, serving 7 counties, with 12 retail offices in Orleans, Essex, Caledonia, Washington, Franklin, and Lamoille counties.

- Asset Size: ~$1 Billion

- Ownership: Public

Banking

Company Profile

FirstBank Southwest was chartered as the First National Bank of Ochiltree in 1907. FirstBank Southwest has nine banking center locations in Amarillo, Booker, Hereford, Pampa, and Perryton, Texas, and has expanded to the DFW Metroplex, Austin, and San Antonio metro markets with Loan and Deposit Production Offices.

- Size: $1.6 Billion in Assets

- Ownership: Private