GTL Achieves a Paperless Reconciliation Process and Goes Green with ART

How It All Started

Founded in 1936 and headquartered in Glenview, IL, Guarantee Trust Life Insurance Company (GTL) is a mid-sized mutual insurer. The Company provides a portfolio of competitive, value-driven health, accident, life and special risk insurance programs to individuals, families and groups across the country.

Following a system upgrade to their general ledger, GTL decided to take the next step and automate their account reconciliation process. Reconciliations were all being done manually, with reconcilers having to print out all their account support and turn it in to their manager for review.

The finance team wanted a better way to coordinate and execute the reconciliation process in a way that would allow the process to become automated, standardized, and paperless.

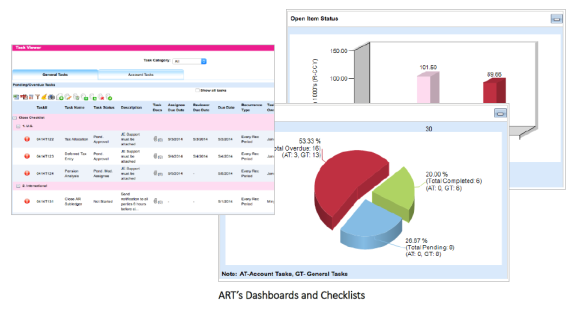

Furthermore, the team wanted a way to streamline the review process through a system workflow and a dashboard. The team invited several vendors to participate in the evaluation process, and ultimately selected SkyStem ART as the solution of choice.

Why ART?

GTL needed to leverage automation to achieve a paperless environment. While there were several solutions available in the market, ART stood out as a top choice due to the following reasons:

“High Touch” Customer Support:

The availability of hands-on customer support was a critical factor for GTL. Due to its sizable staff, the finance team understood that the quality of support received could mean the difference between a successful implementation and a failed project. Because of that, the finance team was keen to partner with a vendor who valued a “high touch” approach to customer support.

User Friendly Interface:

ART provided the functionality that GTL wanted without tacking on too many unneeded features that drove up prices. ART’s functionality was presented in a user-friendly interface which would help to ease adoption and make the onboarding process smoother.

Ease of System Administration:

ART is built for lean organizations that cannot dedicate numerous hours to maintain a new system. In addition to having easy-to-configure system administrator controls, ART also had an option to feed trial balance and subledger information from the general ledger system daily, which reduces the system administration burden.

“We felt like ART and the SkyStem team were the best choice for GTL because of their attentive support process, the favorable return on investment, and ART’s feature flexibility that could be tailored to our needs.”

Implementation and Training

Within 25 days, ART was set up with GTL’s data. Training occurred shortly after, and within one month from project kick-off date, the finance team started its first automated reconciliation cycle.

SkyStem’s implementation process was fast and efficient, which allowed GTL to complete the project in a timeframe that aligned with daily operations and provided minimal disruption to the team’s work.

All users were trained live and in person by a SkyStem subject matter expert. To increase adoption, GTL’s newly minted site was used to train all users, so that they can become familiar with the new process right away.

“I didn’t think we’d be this far along this soon! It’s been a 180 degree turn from where we were.”

The Results

Within 90 days of implementing ART, GTL’s finance team has achieved the infrastructure needed for a paperless environment. In addition, the new automated process resulted in:

- Daily automated refresh of reconciliation balances from Oracle PeopleSoft

- 15% to 20% reduction in reconciliation volume each month

- Company-wide standardization of reconciliation format

- Electronic review notes and feedback process

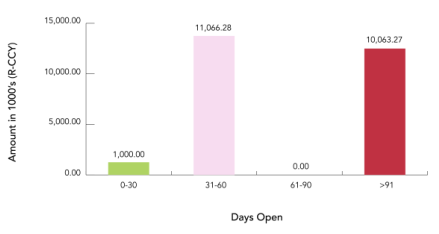

- Real-time access into status, delinquencies and exceptions

- Elimination of all data gathering and administrative time for reporting

- Central repository of all documents

- Instant and real-time monitoring of status and exceptions

Shortly after adopting ART, the finance team suggested a new enhancement for ART. The enhancement suggestion was evaluated internally by SkyStem. Soon after, the feature was designed, built out and made available for all SkyStem customers.

About SkyStem

SkyStem is based in New York and makes a software called ART, a month-end close and balance sheet reconciliation solution that is easy to use and fast to implement. We are proud to offer one of the most affordable and effective solutions of its kind in the market today.

Visit www.skystem.com to access more helpful materials.

Recommended Case Studies

Credit Union

Company Profile

Based in Madison and Milwaukee, with locations around Wisconsin, University of Wisconsin Credit Union (UWCU) has an asset size of over $5 billion, 300,000 members and is the 3rd largest credit union in Wisconsin.

- Customer Industry: Financial Services

- Asset Size: $5 billion

- Accounting Team Size: 13

Banking

Company profile

Operating over 50 locations across Maine, New Hampshire and Vermont, Bar Harbor Bank & Trust is headquartered in Bar Harbor, Maine. As a leading Northern New England community bank, Bar Harbor Bank & Trust offers a full range of personal and business banking services, as well as wealth management services through its subsidiary Bar Harbor Wealth Management.

- Asset size: $4 Billion

- Ownership: Public

Banking

Company Profile

Community National Bank has been serving Vermont communities for over 165 years organized in 1851 as the Peoples Bank, and nationally chartered in 1865 as the National Bank of Derby Line. It is a billion-dollar bank in northeastern Vermont, serving 7 counties, with 12 retail offices in Orleans, Essex, Caledonia, Washington, Franklin, and Lamoille counties.

- Asset Size: ~$1 Billion

- Ownership: Public