Greater Hudson Bank Automates Month-End Close Process with ART

How It All Started

Greater Hudson Bank is a locally-owned, premier New York community bank operating in the counties of Westchester, Rockland, and Orange, NY. The Bank was originally founded in 2002 by business and professional individuals who envisioned a truly local bank to serve the financial needs of the community. Greater Hudson Bank is recognized throughout the industry for its financial strength and quality. But what most distinguishes the Bank is its personalized service and long-term relationships with its customers.

The Bank underwent a go-green initiative and became interested in adopting solutions that could reduce or eliminate paper wherever possible in efforts to conserve natural resources. The finance and accounting department was one area where activities were still very much driven by paper and manual work. In particular, the Bank’s month-end close and reconciliation process was very deadline driven, and each close consisted of many tasks that had to be coordinated between the entire accounting staff, as well as balance sheet reconciliations. Department leadership recognized that in adopting more automation, not only would the department become more environmentally conscious, but it could also streamline the month-end close process to:

- Reduce human errors

- Stay organized to meet tight deadlines

- Improve close infrastructure

- Provide management with more insight during close

The entire finance team, including the CFO, was involved in the vendor selection process. The team saw a demo of ART as well as those of other systems. After comparing several solutions and agreeing that ART would provide the best value for the investment, the Bank guided SkyStem through a rigorous compliance and data security review.

Benefits of the Task Master

Greater Hudson Bank recognized that the key to a consistently smooth month-end close was to stay organized. This was incredibly administrative and cumbersome, as team members had to continually sign and date various checklists and documents, manually track the status of each activity and maintain offline records.

ART’s Task Master offloaded this burden from the finance team, so that team members could focus on closing the books and not be distracted with administrative activities.

The finance team set up the Task Master to:

- Remember recurring activities and automatically create tasks each month.

- Proactively remind task owners of incomplete or delinquent activities.

- Provide a central repository for instructions as well as supporting documentation for each task.

- Display real-time status updates of the close.

“The Task Master really helps to keep the staff on track and see what’s on everyone’s plate instantly, instead of crossing things off on our own handwritten lists.”

Benefits of the Reconciliation Module

ART’s reconciliation module took over routine work that the finance team had been doing. Using a combination of workflow configuration, email alerting, auto-populating of reconciliation data, electronic time stamp, and reporting, the Greater Hudson Bank finance team was able to:

- Reduce paper and go green.

- Centralize reconciliation status tracking.

- Prepare and review reconciliations from anywhere.

- Access reconciliation data and corresponding supporting documents at any time.

- Reduce the number of reconciliations that must be completed each month.

- Refocus time previously dedicated to administrative work to more value-added activities.

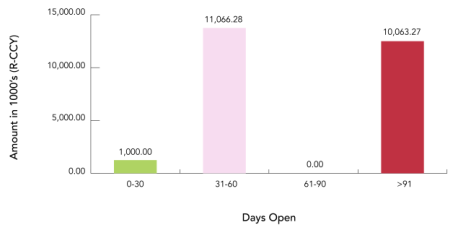

- Access dashboards that quickly alert team members as to whether reconciliation work is 100% completed.

- Achieve complete transparency and enforce accountability of the monthly reconciliation process.

- Extract and archive all reconciliation documentation onto local servers each month.

“The system reconciliation functionality is awesome! If there is a zero balance, there is nothing to do. ART prepares the reconciliations for you! ART will help you save time in the long run so that we can focus our efforts elsewhere.”

Implementation and Customer Support

The initial implementation process consisted of providing the information needed for SkyStem personnel to configure ART. The implementation was completed in one month.

The ability to connect timely with a responsive and knowledgeable customer support team was a value-added element for the Bank, as there were a number of questions raised by the finance team during the first few closing cycles. SkyStem personnel was able to quickly step in to assist with all questions.

Furthermore, a few months after adopting ART, the finance team made an enhancement suggestion that was very quickly accepted by SkyStem and built into ART.

“It’s refreshing to have a good service team. It’s important to know that if you need help on something that they can get back to you quickly with what you need.”

About SkyStem

SkyStem is based in New York City and makes a software called ART, a month-end close and balance sheet reconciliation solution that is easy to use and fast to implement. We are proud to offer one of the most affordable and effective solutions of its kind in the market today. Visit www.skystem.com to access more helpful materials.

SkyStem is based in New York City and makes a software called ART, a month-end close and balance sheet reconciliation solution that is easy to use and fast to implement. We are proud to offer one of the most affordable and effective solutions of its kind in the market today. Visit www.skystem.com to access more helpful materials.

Recommended Case Studies

Banking

Company profile

Operating over 50 locations across Maine, New Hampshire and Vermont, Bar Harbor Bank & Trust is headquartered in Bar Harbor, Maine. As a leading Northern New England community bank, Bar Harbor Bank & Trust offers a full range of personal and business banking services, as well as wealth management services through its subsidiary Bar Harbor Wealth Management.

- Asset size: $4 Billion

- Ownership: Public

Banking

Company Profile

Community National Bank has been serving Vermont communities for over 165 years organized in 1851 as the Peoples Bank, and nationally chartered in 1865 as the National Bank of Derby Line. It is a billion-dollar bank in northeastern Vermont, serving 7 counties, with 12 retail offices in Orleans, Essex, Caledonia, Washington, Franklin, and Lamoille counties.

- Asset Size: ~$1 Billion

- Ownership: Public

Banking

Company Profile

FirstBank Southwest was chartered as the First National Bank of Ochiltree in 1907. FirstBank Southwest has nine banking center locations in Amarillo, Booker, Hereford, Pampa, and Perryton, Texas, and has expanded to the DFW Metroplex, Austin, and San Antonio metro markets with Loan and Deposit Production Offices.

- Size: $1.6 Billion in Assets

- Ownership: Private