Bank Shortens Close and Audit Timeline with ART

How It All Started

Founded in 1915, First Federal Savings started in Twin Falls, Idaho with fifteen people who had a mission to build a loan company. Since making its first loan in 1916, in the amount of $700, First Federal Savings has remained true to its roots and mission while growing to its current asset size of almost $600 million. The bank currently has 11 branches throughout Southern Idaho.

Prior to implementing ART, First Federal Savings’ reconciliation process was completely manual with the use of Excel spreadsheets. The accounting team’s process was not only inefficient, but decentralized, which caused many delays with other projects. The team was also experienced several issues around locating supporting documents during audits, which only increased the number of deadlines missed.

Finally, the team took the initiative to explore solutions that would streamline the reconciliation process. First Federal Savings wanted to be more efficient, focusing on how to streamline the review procedure. With internal and external auditors always asking the accounting team for missing documents, the team needed to establish a centralized and standardized closing process. First Federal Savings essentially wanted a solution that was efficient and offered a way to keep everything in one place. The team also wanted a product with archiving features that allowed them to go back and find supporting documents faster and easier.

First Federal Savings ultimately selected SkyStem’s month-end close and reconciliation automation solution – ART – based on supporting document features, ease of the onboarding process, and the user-friendly experience.

Why ART?

SkyStem’s ART met the accounting team’s objectives in the following key areas:

System Functionality:

One of First Federal Savings’ requirements for a reconciliation tool was to enable a simpler review process, while also allowing visibility into the status of each account. With ART, reconciliation reviewers are able to track progress, providing efficiency and transparency to the reconciliation workflow.

Fast Implementation:

First Federal Savings needed a solution that would not disrupt the team’s schedule as they were already struggling to maintain deadlines due to the previous manual process for reconciliation work. ART was implemented in 20 hours.

Audit Trail:

With ART’s supporting document functionality, the team no longer needed to dig through old files to find supporting documents for audits. Today, the team has significantly shortened the process by centralizing all historical items along with electronic sign-offs.

“ART is fast, not clunky, and the team is able to dive into other accounts they weren’t able to in the past.”

Auditor Satisfaction

ART has been received very positively by First Federal Savings’ auditors. The bank’s internal auditors enjoy working with ART as they can complete mini audits without constantly asking the accounting team for supporting documents. First Federal Savings’ external auditors are also extremely satisfied with the software as it has completely streamlined audit procedures and shortened the auditing process.

The Results

Since implementation, ART has enabled First Federal Savings to achieve the following:

- Shorten the external auditing process.

- Create internal audit efficiencies.

- Review faster and more efficiently.

- Lower risk through high quality reconciliations.

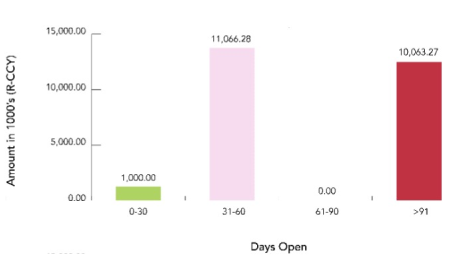

- Report Status in real-time.

- Attach support to reconciliations electronically.

- Instantly access reconciliations and supporting documents from anywhere and at anytime.

- Sign-off electronically.

- Alert users of upcoming deadlines via emails.

- Establish a centralized and standardized closing process each month.

“You can save all the supporting documents into one central location and it’s nice to know that everything is there at the click of a button. It’s also very user friendly and that hasn’t changed with updates.”

Final Words from the Customer

For other organizations looking to implement ART, First Federal Savings’ Controller has the following advice:

“Because ART has increased our accounting team’s efficiencies, it’s a no brainer the team is able to work on other tasks and it has shortened the time it takes to complete financials. Due to new efficiencies and the features ART has to offer, the team now has a lot less risk with what audit can see because the reconciliations are now consistent each month.”

About SkyStem

Headquartered in the heart of New York City, SkyStem delivers a powerful month-end close solution for organizations seeking to streamline their financial processes. The company’s flagship solution, ART, is an enterprise technology that helps CFOs and Controllers shorten the month-end close and the time to issue financials by automating balance sheet reconciliations, managing month-end tasks, performing flux and variance analysis, and providing insightful reporting. The web-based solution streamlines and eliminates up to 90% of manual activities while strengthening internal controls and corporate governance.

Visit www.skystem.com to access more helpful materials.

Recommended Case Studies

Banking

Company profile

Operating over 50 locations across Maine, New Hampshire and Vermont, Bar Harbor Bank & Trust is headquartered in Bar Harbor, Maine. As a leading Northern New England community bank, Bar Harbor Bank & Trust offers a full range of personal and business banking services, as well as wealth management services through its subsidiary Bar Harbor Wealth Management.

- Asset size: $4 Billion

- Ownership: Public

Banking

Company Profile

Community National Bank has been serving Vermont communities for over 165 years organized in 1851 as the Peoples Bank, and nationally chartered in 1865 as the National Bank of Derby Line. It is a billion-dollar bank in northeastern Vermont, serving 7 counties, with 12 retail offices in Orleans, Essex, Caledonia, Washington, Franklin, and Lamoille counties.

- Asset Size: ~$1 Billion

- Ownership: Public

Banking

Company Profile

FirstBank Southwest was chartered as the First National Bank of Ochiltree in 1907. FirstBank Southwest has nine banking center locations in Amarillo, Booker, Hereford, Pampa, and Perryton, Texas, and has expanded to the DFW Metroplex, Austin, and San Antonio metro markets with Loan and Deposit Production Offices.

- Size: $1.6 Billion in Assets

- Ownership: Private