Total Accountability Through Month-End Close Automation

How It All Started

CountryMark is an American-owned oil exploration, production, refining and marketing company. The company’s complete line of premium quality liquid fuels begins with light, sweet crude oil, which is refined to the highest specifications at the CountryMark refinery in Mt. Vernon, Indiana. Fuel quality is protected as it travels north along their 238- mile private pipeline. State-of-the-art blending technology at each CountryMark fuel terminal ensures their biodiesel & ethanol blended fuels are formulated for optimal driving performance and winter operability. CountryMark has also been a farmer-owned cooperative since 1919 and remains one of the largest agriculture cooperatives in the nation today.

CountryMark’s account reconciliation process was very manual and increasingly laborious. Before adopting ART, the accounting team was only able to process 26% of their reconciliations during the month-end close process. Controllers and management would then take extra time to match up reconciliations with their corresponding supporting documentation which were scattered throughout various folders on shared drives, and signoffs consisted of manually typing in names into a spreadsheet.

From experience, the management team knew businesses that focused heavily on their balance sheets tend to be successful due to their consistent growth. CountryMark grasped the limitless possibilities of what an automated solution could provide and narrowed down their search to three month-end close providers.

During a demo of SkyStem’s solution, ART, CountryMark immediately realized the ROI for their entire company and how it could eliminate their current cumbersome process, especially during audits. ART appealed to their entire team in how ART would save them time and provide insightful reporting at an affordable price. After a competitor comparison, a decision was eventually made to adopt ART, SkyStem’s month-end close automation solution.

Why ART?

SkyStem ART met CountryMark objectives in the following key areas:

Reduce Administration:

The accounting team was drawn to the reporting abilities and the various dashboards in ART. The high-level monitoring feature removed much of the administrative work that was required prior to automation, allowing CountryMark to do their work faster and providing deeper insight into their close process.

Speedy and Non-Disruptive Implementation:

Setting up ART didn’t require full-time resources or outside consultants and was done in a matter of weeks.

Save Time:

Over 10% of balance sheet accounts are now system reconciled each month. System reconciliation capabilities monitor account balances and substantially reduce the number of accounts that require reconciliation.

Audit Trail:

With ART’s electronic sign-off functionality, the team no longer needed to manually sign-off on each reconciliation and closing task. ART has reduced the overall time previously spent on audits.

System Functionality:

One of CountryMark’s requirements for a reconciliation tool was allowing visibility into the status of each account. With ART, reconciliation reviewers are able to track progress, gain efficiency & transparency of the reconciliation workflow.

Implementation & Training

With minimal disruption to the team, all users were trained directly by SkyStem personnel, who are knowledgeable about the month-end close and reconciliation process. Prior to launching ART, CountryMark’s dedicated implementation expert met with the team to address their objectives and goals. The company received hands-on training from SkyStem, who guided CountryMark users and administrators throughout the entire process. Detailed job aids provided step-by-step direction for future reference, as well as various live- and web-based training are available throughout implementation and beyond.

The Results

Since implementation, ART has enabled CountryMark to achieve the following:

- Establishing a centralized and standardized closing process.

- Having over 10% of the balance sheet system reconcile each month.

- Retrieving actionable insight for analysis with real-time report status, reconciliations and supporting documents.

- Alerting users of upcoming deadlines via emails.

- Improving risk prevention through high quality reconciliations.

- Processing 2-3 times more reconciliations in the same timeframe.

- Reviewing faster and more efficiently.

- Ability to make Reconciliation data and audit trail information electronically available to auditors.

- Attaching support to reconciliations and sign-off electronically.

“We’re in a continuous changing environment and ART has been a gamechanger for us to make some process efficiencies everywhere.”

Final Words from the Customer

For other organizations looking to implement ART, CountryMark’s Director of Accounting has the following advice:

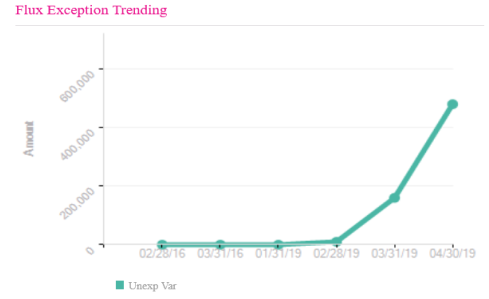

“SkyStem has taken us into the future by being able to quickly review, sign off and get feedback on those reviews. We’ve totally revamped our finance and accounting group be more in tune with the analytics that ART provides, which has helped us make better business decisions for the entire company. The reporting and analytics tools have completely changed our process, especially the flux feature by allowing us to put the attention where it needed to be.”

About SkyStem

Headquartered in the heart of New York City, SkyStem delivers a powerful month-end close solution for organizations seeking to streamline their financial processes. The company’s flagship solution, ART, is an enterprise technology that helps CFOs and Controllers shorten the month-end close and the time to issue financials by automating balance sheet reconciliations, managing month-end tasks, performing flux and variance analysis, and providing insightful reporting. The web-based solution streamlines and eliminates up to 90% of manual activities while strengthening internal controls and corporate governance.

Visit www.skystem.com to access more helpful materials.

Recommended Case Studies

Credit Union

Company Profile

Based in Madison and Milwaukee, with locations around Wisconsin, University of Wisconsin Credit Union (UWCU) has an asset size of over $5 billion, 300,000 members and is the 3rd largest credit union in Wisconsin.

- Customer Industry: Financial Services

- Asset Size: $5 billion

- Accounting Team Size: 13

Banking

Company profile

Operating over 50 locations across Maine, New Hampshire and Vermont, Bar Harbor Bank & Trust is headquartered in Bar Harbor, Maine. As a leading Northern New England community bank, Bar Harbor Bank & Trust offers a full range of personal and business banking services, as well as wealth management services through its subsidiary Bar Harbor Wealth Management.

- Asset size: $4 Billion

- Ownership: Public

Banking

Company Profile

Community National Bank has been serving Vermont communities for over 165 years organized in 1851 as the Peoples Bank, and nationally chartered in 1865 as the National Bank of Derby Line. It is a billion-dollar bank in northeastern Vermont, serving 7 counties, with 12 retail offices in Orleans, Essex, Caledonia, Washington, Franklin, and Lamoille counties.

- Asset Size: ~$1 Billion

- Ownership: Public