ART Gives Auditors What They Really Need

How It All Started

Citizens and Farmer’s (C&F) Bank is a publicly traded financial institution founded in 1927. Based in Virginia with $2 billion in assets, C&F Bank has five subsidiaries and offers community banking, mortgage lending, and consumer finance services.

With three separate accounting departments, the month-end close relied heavily on paper, which quickly become burdensome when it came to activities like pulling requests for auditors.

“It was not very efficient. There was a lot of paperwork. My team would prepare the reconciliations, print them out, sign them with all the support, put them on my desk and I would review them on paper. Then we would box them up at the end of the month and store them,” Corporate Controller Matt Guth recalls. “Pretty much every night during the month-end close I would leave work with a huge stack of papers.”

Due to the large volume of reconciliations, after closing there would still be corrections, necessary reviews, or even unreconciled accounts. Matt remembered a former client who had a reconciliation tool and how much more efficient it made the process. After consulting with management, C&F Bank discovered they already had a reconciliation tool, which was never fully implemented due to its complexity.

The department chose to move forward with pursuing an alternative solution and evaluated several different options on the market. Essential criteria were cost-effectiveness, flexibility, and simplicity of use.

In 2019 C&F Bank decided to implement ART by SkyStem. “It wasn’t too hard of a sell,” Matt mentioned. “We just had to find the right tool for us.”

Why ART?

SkyStem’s ART met C&F Bank’s key objectives in the following areas:

Standardization:

The accounting team previously used cover sheets in Excel to handle reconciliations. This led to inconsistencies between different employees, as each person had their own way of working. ART’s standard forms allowed C&F to have more uniform reconciliations.

Eliminating Paper:

Digitizing the month-end close took away the burden of storing piles of reconciliations and documentation. Additionally, the work could now be done from anywhere.

Streamlined Workflow:

A larger team working at different times can lead to complications. Automating due dates and assignments with email alerts and electronic sign-offs helped ensure tasks were done on time.

Flexible Functionality:

With the project management module, the team had tools for work outside regularly occurring activities. The department also utilized ART to document controls outside of the month-end close.

Painless Implementation:

With no need to involve the Bank’s IT team, ART was able to get up and running within one month. “It was very easy,” remembers the Corporate Controller.

Happier Auditors:

Before going paperless, employees took longer to find and pull requests. After implementing ART, the auditors were able to find the information easily, on their own.

“That’s one thing I really like about ART. It gives auditors to access and allows them to pull anything they need directly without coming to me or my team.”

– Corporate Controller, C&F Bank

The Results

- In the years since adopting ART, C&F’s accounting team has come a long way. An initial learning curve from the new technology posed a challenge, but with help from SkyStem’s dedicated customer support, the team was able to successfully transition to a digital and automated month-end close.

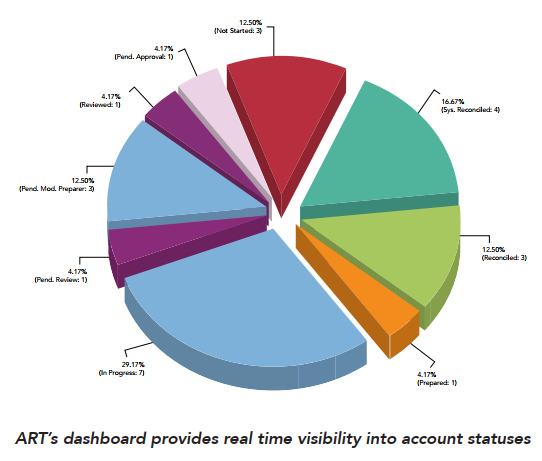

- With internal audits happening quarterly and external audits twice yearly, ART has significantly cut down on the time it takes to find and send items during audits. Auditors can download reconciliations and review sign-offs and documentation—all with their own log-in. With the audit license configurable to grant or restrict access to notes, periods, accounts, and status, C&F Bank has the flexibility to work with auditors on their terms.

Final Words from the Customer

For other organizations looking to implement ART, C&F Bank’s Corporate Controller has the following advice:

“You’re not going to be able to get from what you’re doing to a perfect system overnight. Having that clean cutoff is the best way to go. Otherwise, you can prolong some of those issues that come from a change. Now everyone seems to be onboard and sees the benefits of it.”

About SkyStem

Headquartered in the heart of New York City, SkyStem delivers a powerful month-end close solution for organizations seeking to streamline their financial processes. The company’s flagship solution, ART, is an enterprise technology that helps CFOs and Controllers shorten the month-end close and the time to issue financials by automating balance sheet reconciliations, managing month-end tasks, performing flux and variance analysis, and providing insightful reporting. The web-based solution streamlines and eliminates up to 90% of manual activities while strengthening internal controls and corporate governance. Visit www.skystem.com to access more helpful materials.

Recommended Case Studies

Banking

Company profile

Operating over 50 locations across Maine, New Hampshire and Vermont, Bar Harbor Bank & Trust is headquartered in Bar Harbor, Maine. As a leading Northern New England community bank, Bar Harbor Bank & Trust offers a full range of personal and business banking services, as well as wealth management services through its subsidiary Bar Harbor Wealth Management.

- Asset size: $4 Billion

- Ownership: Public

Banking

Company Profile

Community National Bank has been serving Vermont communities for over 165 years organized in 1851 as the Peoples Bank, and nationally chartered in 1865 as the National Bank of Derby Line. It is a billion-dollar bank in northeastern Vermont, serving 7 counties, with 12 retail offices in Orleans, Essex, Caledonia, Washington, Franklin, and Lamoille counties.

- Asset Size: ~$1 Billion

- Ownership: Public

Banking

Company Profile

FirstBank Southwest was chartered as the First National Bank of Ochiltree in 1907. FirstBank Southwest has nine banking center locations in Amarillo, Booker, Hereford, Pampa, and Perryton, Texas, and has expanded to the DFW Metroplex, Austin, and San Antonio metro markets with Loan and Deposit Production Offices.

- Size: $1.6 Billion in Assets

- Ownership: Private