Journey into Month-End Close Automation

How It All Started

Aquarion Water Company, a subsidiary of Eversource, is a public water supply company for Connecticut, Massachusetts and New Hampshire residents with approximately 230,000 customers. Founded in 1857, as a means to deliver fresh water to sailors and merchants, the company has evolved into the largest investor-owned water utility in New England and is among the seven largest in the United States.

Prior to implementing ART, Aquarion’s month-end close and reconciliation process was pretty traditional — predominantly manual with the use of paper and Excel spreadsheets. With the business expanding and the accounting team kept fairly lean, the increased burden contributed to the accounting processes becoming more inconsistent and decentralized. The team had recently implemented SAP, which while helpful, didn’t provide all the analytics and automation they needed specifically for month-end close.

In particular, review of reconciliations during the close was completed by flipping through printed pages, manually signing off and collating workpapers into binders, and storing them in cabinets for future audits. Overall, the process worked but was too clunky and cumbersome for the team’s liking. Manual work comes at a cost. It required a disproportionate amount of effort to complete and depleted valuable human resources. In addition, the team lacked insight into the close since status checks were difficult and slow to do. This required management to be extra diligent and spend even more time on managing the close and reconciliation process.

Eventually, the team took the initiative to explore solutions that can provide a clearer picture into the whole month-end close process and to be able to track the status and exceptions from reconciliation work. The accounting team evaluated several solutions and chose SkyStem ART.

Why ART?

SkyStem’s ART met the Aquarion team’s objectives in the following key areas:

Audit Readiness:

Aquarion’s accounting team was having difficulty locating supporting documents in a timely manner. Today, the team has shortened the process by centralizing all work papers and supporting documents along with electronic sign-offs.

Speedy and Non-Disruptive Implementation:

Setting up ART didn’t require full-time resources or outside consultants and was done in a matter of weeks.

Customer Support:

Hands-on assistance during implementation and beyond was a big bonus that many vendors do not offer. The availability of knowledgeable customer support for both beginner and expert users is abundant and caters to all types of learning preferences: job aids, FAQs, live- and web-based trainings.

System Reconciliation Capabilities:

Automatic reconciling of certain accounts that could substantially reduce the overall number of accounts requiring reconciliation was a very attractive feature.

Transparency and accountability:

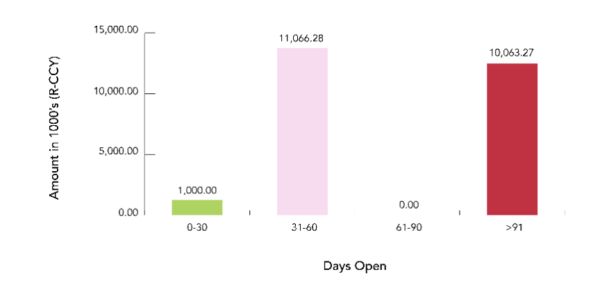

Various high-level dashboards and detailed reports were available and customizable for executive’s needs.

“I wished we would have adopted ART sooner as the automated process was smoother than a manual process.”

Implementation & Training

SkyStem ART was the first cloud-based application that the accounting team adopted, so it underwent careful scrutiny by Aquarion’s IT team. Implementation was completed in less than four weeks’ time. All users were trained directly by SkyStem personnel, who were

knowledgeable about reconciliation best practices.

The accounting team initially struggled to adopt ART due to a big organizational change. However, the team never gave up on the reconciliation project and did a full reconciliation cycle in ART two months later. Having experienced this initial success, users became eager to adjust ART’s capabilities for Aquarion’s business needs. As a result, the team was able to further reduce reconciliation volume and are now exploring advanced features to streamline the process even more.

Aquarion went from not having a defined system to a risk-lowering, totally transparent automated month-end reconciliation process with built-in accountability.

The Results

Since implementation, ART has enabled Aquarion to achieve the following:

- Decrease financial statement risk through high quality reconciliations.

- Faster and easier electronic sign offs.

- Automatic deadline email alerts.

- Better satisfy internal and external auditors.

- Instantly access reconciliations and supporting documents.

- Real-time reconciliation statuses.

- Less time spent on review and status retrievals.

- Printing and manual archiving is avoided.

- Reconciliation process is standardized and centralized with ART’s standard forms.

“ART helped significantly reduce our audit research time, as we can now go through various periods and find whatever is needed within minutes.”

Final Words from the Customer

For other organizations looking to implement ART, Aquarion Corporate Controller has the following advice:

“Change is hard but good, you will have better control, visibility and all the help you need once complete. Our biggest benefit received from ART is the depth of the control and insight on the close. It helped us maintain confidence in our numbers.”

About SkyStem

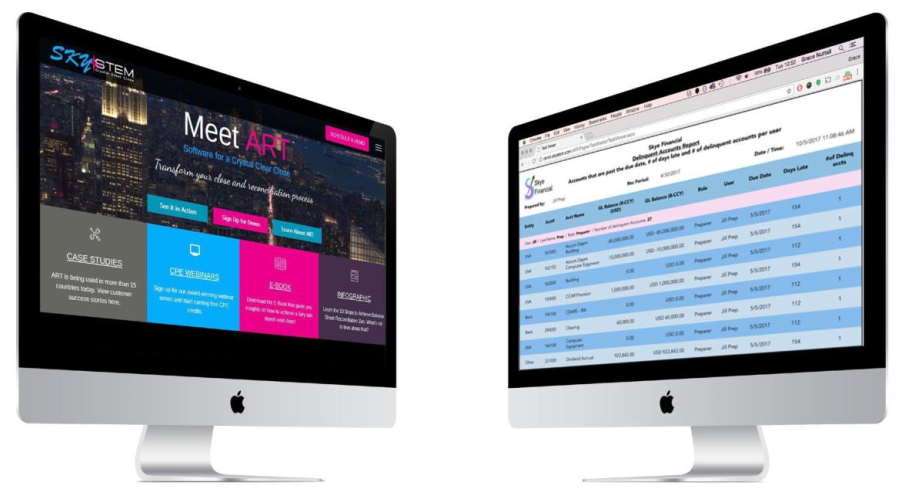

Headquartered in the heart of New York City, SkyStem delivers a powerful month-end close solution for organizations seeking to streamline their financial processes. The company’s flagship solution, ART, is an enterprise technology that helps CFOs and Controllers shorten the month-end close and the time to issue financials by automating balance sheet reconciliations, managing month-end tasks, performing flux and variance analysis, and providing insightful reporting. The web-based solution streamlines and eliminates up to 90% of manual activities while strengthening internal controls and corporate governance.

Visit www.skystem.com to access more helpful materials.

Recommended Case Studies

Credit Union

Company Profile

Based in Madison and Milwaukee, with locations around Wisconsin, University of Wisconsin Credit Union (UWCU) has an asset size of over $5 billion, 300,000 members and is the 3rd largest credit union in Wisconsin.

- Customer Industry: Financial Services

- Asset Size: $5 billion

- Accounting Team Size: 13

Banking

Company profile

Operating over 50 locations across Maine, New Hampshire and Vermont, Bar Harbor Bank & Trust is headquartered in Bar Harbor, Maine. As a leading Northern New England community bank, Bar Harbor Bank & Trust offers a full range of personal and business banking services, as well as wealth management services through its subsidiary Bar Harbor Wealth Management.

- Asset size: $4 Billion

- Ownership: Public

Banking

Company Profile

Community National Bank has been serving Vermont communities for over 165 years organized in 1851 as the Peoples Bank, and nationally chartered in 1865 as the National Bank of Derby Line. It is a billion-dollar bank in northeastern Vermont, serving 7 counties, with 12 retail offices in Orleans, Essex, Caledonia, Washington, Franklin, and Lamoille counties.

- Asset Size: ~$1 Billion

- Ownership: Public